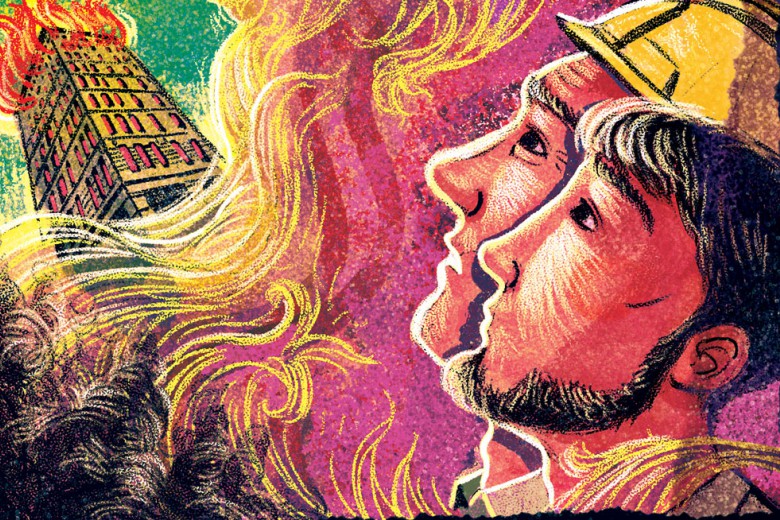

“Buy this car to drive to work

drive to work to pay for this car.”

Metric

When the world is combusting all around us, it seems a little petty to devote an entire issue of Briarpatch to questions of debt and personal finance. But in many ways, the subject couldn’t be more pressing or more in need of radical intervention. Canadians’ debt levels have never been higher, and widespread indebtedness, in addition to serving as an effective vehicle for transferring more wealth to the wealthy, also acts as a powerful means of social control. Debt restricts people’s choices, compelling them to work longer hours at jobs they hate, and limits their ability to unplug from the engine of growth and to seek out alternate ways of sustaining themselves and their communities.

Consider, for example, the plight of your average post-secondary student today, who graduates with $24,000 in student loans and who has, throughout her academic career, been bombarded with credit card offers inviting her to take on even more debt. Many graduating students emerge armed with more knowledge, confidence and critical thinking skills to engage with the world on their own terms, but have little choice but to take the first or highest paying job they’re offered so they can start making payments on their mountain of debt. They’ve paid dearly for their entry ticket to the middle class, and if the banks and mortgage brokers have anything to say about it, they’ll continue paying for the rest of their lives.

Getting yourself out of debt won’t save the world—but it’s actually not a bad place to start. It’s like the standard air travel safety spiel: secure your own mask before assisting others. If you want to save the world, our thinking goes, then get out of debt, cut back on your spending, work less, and devote your resulting time, energy, and resources to all the things that you know need to be done and that no one will ever pay you to spend your time doing.

In the following pages, you’ll find inspiring case studies of communities rethinking their relationships with money (by creating their own!), trailblazing individuals perpetrating their escapes from the rat race, a cautionary tale of the U.S. housing/credit collapse and more—all geared to help us rethink our relationship with money and to begin seeing ourselves as more than just consumers.