Global capitalism is on the precipice of another major downturn. The business media features an endless stream of worried reports about slowing economic growth, high levels of business and consumer debt, and trade wars. The world economy never recovered from the 2007–09 financial crisis. While a decade of stagnation has only intensified the hardship faced by workers and the poor across the globe, another recession will be devastating for them.

Canadian capitalism is not isolated from these problems; it experiences the same frenetic rhythms of the boom-and-bust cycle as the rest of the world. Indeed, Canadian capitalism has itself entered a period of serious volatility, the consequences of which could be both economically and politically severe.

While a decade of stagnation has only intensified the hardship faced by workers and the poor across the globe, another recession will be devastating for them.

These developments have implications for climate justice, workers’ rights, and anti-austerity organizers and activists. It is therefore worth exploring the forces behind capitalist crises, the impact of another recession on Canada – one that may well be deeper than that which hit Canada in 2008 – and the likely response by Canadian capitalists and the state. The goal of the Canadian ruling class in such a situation will be, as is always the case in periods of capitalist instability, to impose the hardships of recovery on the backs of workers, Indigenous peoples, and migrants, while intensifying ecological plunder.

Crisis and the laws of motion of capitalism

Crises occur regularly in capitalism, but economists, business leaders, and the mainstream media rarely offer an explanation of them that strays beyond the superficial or that meaningfully interrogates the way that crisis is encoded in capitalism’s DNA. And yet long periods of instability characterized capitalism in the 1840s, 1870s, 1930s, 1970s, and today. During such long periods of instability, recessions tend to be deep and protracted, and recoveries shallow and fleeting.

Underlying all of these periods of instability are the same basic patterns, even if the immediate precipitating events differ from downturn to downturn (a stock market crash here, the bursting of a real estate bubble there). At the heart of these crises are the contradictions of a system for the production and distribution of society’s wealth that is governed by the pursuit of profit above all else.

This was Karl Marx’s observation 150 years ago, but it continues to be ignored by mainstream economists even today. Far more powerful and revealing than what we are normally told by the usual suspects, Marx’s dissection of the “laws of motion of capitalism” – which frame all aspects of capitalist life – remains indispensable today for those of us wanting to make sense of capitalism’s contradictions as we organize to change the world.

Underlying all of these periods of instability are the same basic patterns, even if the immediate precipitating events differ from downturn to downturn.

Capitalism is a social order in which productive wealth is privately owned and is deployed solely to make profit. Capitalists (the owners of capital) do not invest their money to meet human need. If they meet a human need (“real” or “manufactured”), it is always second to their principal goal of making a profit. Capitalist production, therefore, “should never be depicted as something that it is not, i.e. as production whose immediate purpose is consumption. [...] This would be to ignore completely its specific character,” writes Marx. The existence of a homelessness crisis in Toronto amid an explosion of real estate investment and of hunger worldwide despite sufficient food being produced for every person on the planet to have a healthy diet should serve as brutal reminders of this reality.

The leading determinant of stability in capitalist societies, therefore, is not human well-being; nor, of course, is it ecological sustainability. It is, rather, profitability. A positive profitability forecast energizes capitalist investment in new technology, machinery, and equipment; it encourages the expansion of infrastructure and stokes employment growth. If profitability declines, firms are unlikely to invest in these things, employment falls, and downward pressure on wages increases. Periods of growth and decline in corporate profitability are indelible features of capitalism, and they influence the aggressiveness of ruling-class strategies toward workers and ecologies, thereby transforming our lives in profound ways. The fall of capitalist profitability is at the root of crises, so it is important to take a moment to explore this dynamic further.

For Marx, the fundamental relationship in capitalism, “the hidden basis of the entire social edifice,” is that between the direct producers (the working class) and the owners of the means of production (the capitalist class). This is because “living labour” – the physical and mental energies that workers expend at work – is the source of new value. In capitalist production, workers are compelled to produce more value than the value of their wages. This “surplus value” is the source of profit. Surplus value in capitalist production is not, however, the only source of profit. This is particularly apparent in colonial or settler-colonial settings, where capitalists seek to expropriate wealth from communities living outside of – or at least not fully dependent on – market relations. Indigenous communities are subject to capital’s relentless drive to gain control over land and resources. These forced transfers of wealth into the market can also be a source of profit.

Periods of growth and decline in corporate profitability are indelible features of capitalism, and they influence the aggressiveness of ruling-class strategies toward workers and ecologies, thereby transforming our lives in profound ways.

In capitalist production, living labour, “labour existing as process and as action,” sets in motion the products of past labour represented by machinery, equipment, buildings, structures, and raw materials (that is, “objectified” labour) to produce new commodities for capitalists to sell. “Labour,” Marx argued, “is the yeast thrown into [objectified labour], which starts it fermenting.” But objectified labour only imparts to the final product the value already embodied in it (which comes from past living labour), while the sweat and intellectual exertions of living labour create new value, part of which capital hopes to realize as profit.

For example, the capitalist spends a given amount of money on machinery and raw materials. These costs are transferred to the final product over the lifespan of these means of production. During the course of production, the machine gradually wears out and eventually must be replaced when it has imparted all of the value contained within it to the commodities it produces. A $10,000 machine cannot add more than $10,000 to the final product. The machine is not, therefore, a source of surplus value. “Living labour,” on the other hand, as the physical and mental exertion of human labour power, is different than machinery. Unlike machinery, workers can be (and, by successful capitalists, are) compelled to produce more value for the capitalists than their cost, that is the value of their wages. This is the social basis for the historical struggle over the wage rate, the intensity of work, and the length of the working day, as bosses seek to squeeze more value out of workers than the amount that workers are paid.

At the same time, individual capitalists do not invest in isolation from one another. They are engaged in a ruthless struggle. Competition, Marx noted, “is nothing other than the inner nature of capital.” In their determination to sell their commodities to an ever-larger number of people, businesses compete to sell their commodities for less than their rivals. Every company, big or small, is thus compelled to keep their costs down while making the greatest amount of profit. To do this, they invest in new machinery, equipment, buildings, and structures – all of this expands the scale of production and increases productivity, thereby reducing the costs per unit. This is called capital accumulation. The production of profit and the transformation of a portion of it back into capital is, therefore, “the immediate purpose and the determining motive of capitalist production,” Marx writes. “Accumulate, accumulate! That is Moses and the prophets!”

But objectified labour only imparts to the final product the value already embodied in it (which comes from past living labour), while the sweat and intellectual exertions of living labour create new value, part of which capital hopes to realize as profit.

A number of important things follow from this:

Capitalists’ ability to exercise control over labour – to boost its productivity as much as possible while keeping its costs contained – is paramount. Underlying this drive to constantly hike productivity and contain labour costs, Marx argued, is capitalists’ effort to raise what he called the rate of exploitation or surplus value: essentially the amount of new value workers produce relative to the value of their wages or “labour power.” The rate of exploitation is a key determining factor in the profitability – the “health” – of the capitalist organism.

The compulsion to control labour and increase exploitation lies behind the despotic rule capitalists exercise in the workplace with the legal backing of the state. The only limit to the bosses’ power is that which the workers’ movement actively imposes. Struggle is at the heart of labour relations. In its desire for greater rights, control over its own body, and a material and psychological fulfillment denied by its alienated existence under capitalist social relations, labour exists as “the negation of capital,” frustrating capitalists’ dreams for unchallenged domination of the workplace and society.

The compulsion to increase productivity – and exercise control over workers – also leads to the expulsion of living labour from the production process and its progressive replacement by new technology, machinery, and equipment. In the celebratory words of a Canadian industry trade publication from the early 20th century, the machine “can work the whole twenty-four hours without stopping, knows no distinction between Sundays, holidays and any ordinary day, requires as its lubricant only a little oil […] has no near relatives dying at awkward moments […] belongs to no labour organization […] and its only ambition in life is to do the best possible work in the greatest possible quantity.”

But the progressive displacement of living labour from the production process in the war for market share has an unintended consequence. While it can lower costs of production and thus the prices of the items being produced, it ultimately leads to what Marx referred to as a rising organic composition of capital: that is, it leads to an increase in the ratio of that which does not produce new value (objectified labour embodied in machinery and equipment) to that which does add new value (living labour). As workers are expelled from the production process, the source of surplus value – and hence profit – is progressively undermined. As a result, capitalism has difficulty maintaining sufficient profitability. This is Marx’s “law of the tendential fall in the rate of profit,” which he argued is “the most important law of modern political economy.”

As capitalism grows, it undermines profit – the very source of growth. And it is waning profitability that lies behind capitalist instability and crises, whether these are precipitated by a stock market crash or the bursting of a real estate bubble. (1)

As workers are expelled from the production process, the source of surplus value – and hence profit – is progressively undermined. As a result, capitalism has difficulty maintaining sufficient profitability.

There are, however, forces working against the tendency toward crisis. For instance, if capitalists can increase the rate of workers’ exploitation by increasing the pace of work, keeping wages low, or lengthening working time, they can offset the impact of a rising organic composition of capital on the profit rate, at least for a time. The rising organic composition of capital can also be offset if increases in productivity cheapen the costs of new technology and machinery for capitalists. Aided by states, capitalists may also seek out new sources of cheap labour power, raw materials, or markets for their products through foreign trade and investment. Some investors will seek out speculative opportunities, chasing the seemingly easy profit from – and thus contributing to – unsustainable real estate or stock market bubbles. Companies will also redouble efforts to sell ever more of their goods and services, staving off the impact of the declining profit rate by expanding the total profit they earn by privatizing public assets and services, thereby prying open new areas for profit making.

But like the climate change-induced floodwaters surging against the levee, crises eventually burst through, leaving destruction and suffering in their wake. A testament to the utter irrationality of capitalism, crises in fact help to create the conditions for stability. They are, Marx observed, “never more than momentary, violent solutions for the existing contradictions, violent eruptions that re-establish the disturbed balance for the time being.”

Crises are are, Marx observed, “never more than momentary, violent solutions for the existing contradictions, violent eruptions that re-establish the disturbed balance for the time being.”

Companies are ruined, unemployment spikes, and wage rates drop. Surviving capitalists can try to take advantage of high unemployment to increase the rate of exploitation and eat up more market share opened by the disappearance of rivals. They can also gobble up more cheaply the assets of their vanquished competitors during bankruptcy fire sales. In this context, it is possible for profitability to be restored. The crisis creates the conditions in which a new upturn may occur and a new course is set toward the next “violent eruption.” As Paul Mattick observed, “depression is a precondition for prosperity; prosperity comes to an end in a new depression. They are, so to speak, two sides of the same coin.”

Crises, it should be stressed, exacerbate capitalism’s ecologically destructive impulses. The flip side of workers’ exploitation is the degradation of nature. But during times when capitalism faces deepening profitability problems, the need to control nature and extract as much as possible from it reaches a fever pitch.

With specific respect to Canada, it is never predetermined who will bear the brunt of the resolution of crises, even if the scales are tipped heavily in favour of those who wield power and privilege. It is always a product of struggle: the struggle to defend wages and working conditions, social benefits, and the land and water; or to impose “violent solutions” and restore profitability on the backs of workers, the poor, Indigenous peoples, and the environment.

Canada in the current conjuncture

Canadian capitalism has become increasingly unstable over the last decade and a half – and it is likely to get worse, with another global crisis looming.

It suffered less than the U.S. and Europe in the 2007–09 global financial crash. The very deep recession in the early 1990s (the deepest in Canada since the Great Depression of the 1930s) led to the destruction of wide swaths of capital (thereby freeing up market share for companies that survived the culling) and a sharp increase in unemployment and thus worker vulnerability. Capitalists and the state seized the opportunity to aggressively attack social programs (which offered a non-market income for workers), unions, and workers’ rights more generally – all moves intended to increase worker vulnerability. Meanwhile, employers in certain sectors, such as agriculture, light manufacturing, caregiving, and truck driving, have drawn heavily on vulnerable temporary migrant labourers.

Profitability was successfully restored as wage growth was contained and labour productivity boosted, both outcomes of the recession itself and state policy. Inequality, as a result, hit levels not seen since before the Second World War. While by no means unscathed by the 2007–09 crisis, over a decade of robust profitability and improving business balance sheets before the crisis offered Canadian capitalists a buffer against its worst effects, which would be felt elsewhere in the world.

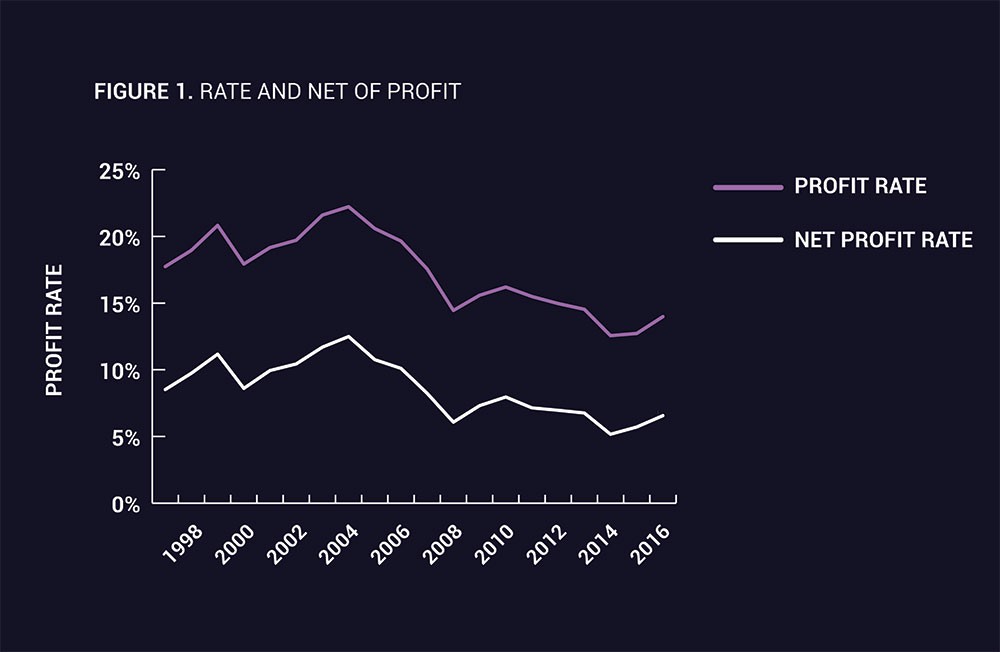

But the fortunes of Canadian capitalism have shifted. (2) As Figure 1 shows, the average net profit rate in 2005 was 12.5 per cent. (3) By 2017, it had fallen to 6.6 per cent. Canada has not seen such poor profitability for three decades, just before the Great Canadian Slump of 1990–92. The profit rate measures the return on total investment.

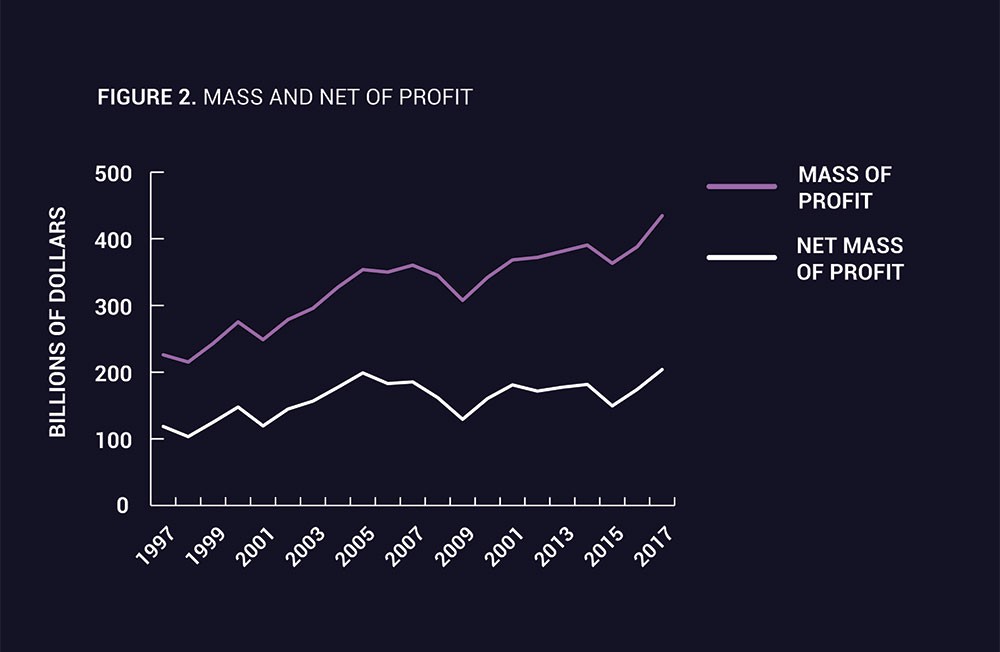

While the rate of profit is an index of profitability, a percentage, the more important indicator for capitalist stability is the mass of profit or, after deducting the wages of unproductive workers such as managers (that is, workers who do not produce surplus value), the net mass of profit. The mass of profit is the magnitude of profit generated in a given period – say, $203 billion. The net mass of profit grew from the end of the Great Canadian Slump of 1990–92 until 2005. As shown in Figure 2, it began to stagnate thereafter and only in 2017 grew beyond its pre-recession high in 2005. When the surplus value generated just covers the cost of new investments, the mass of profit stagnates. Adding new machinery and equipment produces no additional profit and businesses therefore stop investing. If adding one more machine nets no additional profit, the incentive to invest disappears. In Canada, profitable avenues for new business investment have been waning for well over a decade, and this has translated into growing political-economic instability in the country, as employment and output stagnated and a debt-driven real estate boom grew to never-before-seen proportions.

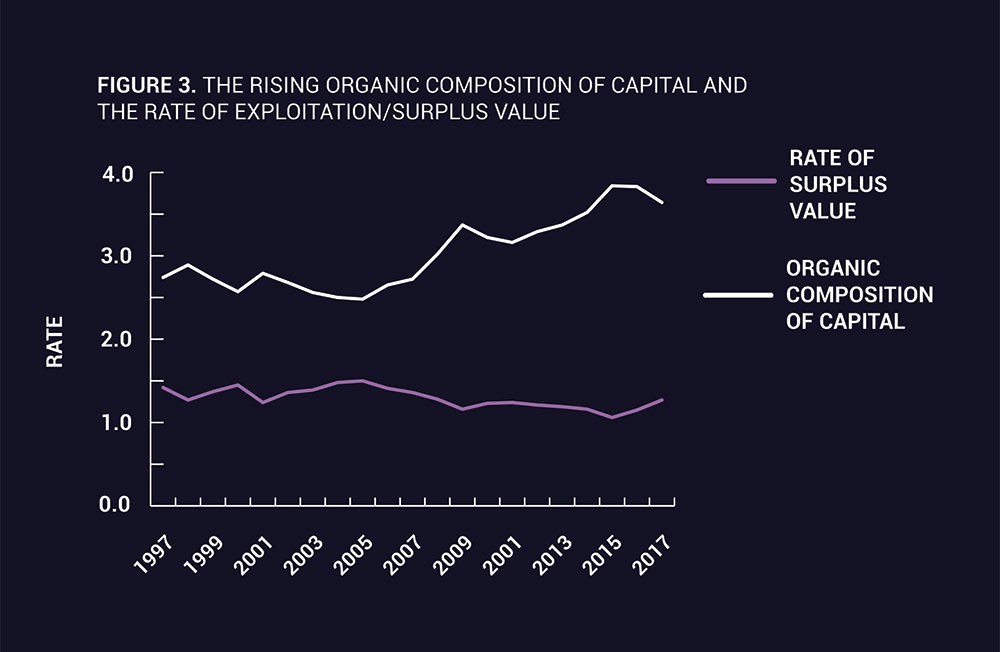

Underlying Canada’s profitability problems are a rising organic composition of capital (that is, the growth that does not produce new wealth – machinery and technology – relative to that which does – living labour) and a stagnating rate of exploitation. Since 2006, the rate of exploitation has stagnated, whereas the organic composition of capital has risen. As companies fight one another for market share, they have not been able to pump sufficient value out of their workforce to keep pace with the growth of new machinery and technology. The sharp decline in the mass of profit was marginally reversed in 2016–17 due to a modest increase in the rate of exploitation in those years, as productivity grew by 3 per cent 2015–2017 while the real hourly median wage stagnated, growing a mere 0.7 per cent; nevertheless, the long-term trend presents a difficult situation for Canadian capitalism, one that is unlikely to be rectified without a more aggressive push to increase exploitation.

The dangers facing Canadian capitalism in this period are paralleled in the U.S. This is important to consider because the U.S. is Canada’s principal trading partner (it receives three-quarters of Canadian exports ) and because of the role foreign trade plays as a countertendency to the falling rate of profit. Stagnant U.S. growth will likely mean stagnant imports, magnifying Canada’s already significant profitability problems.

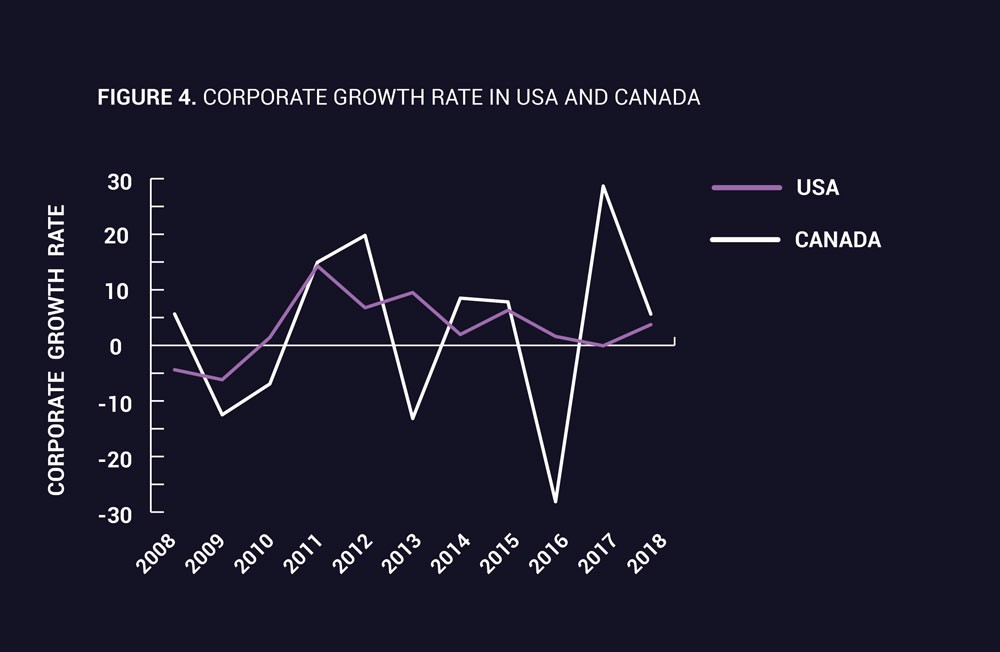

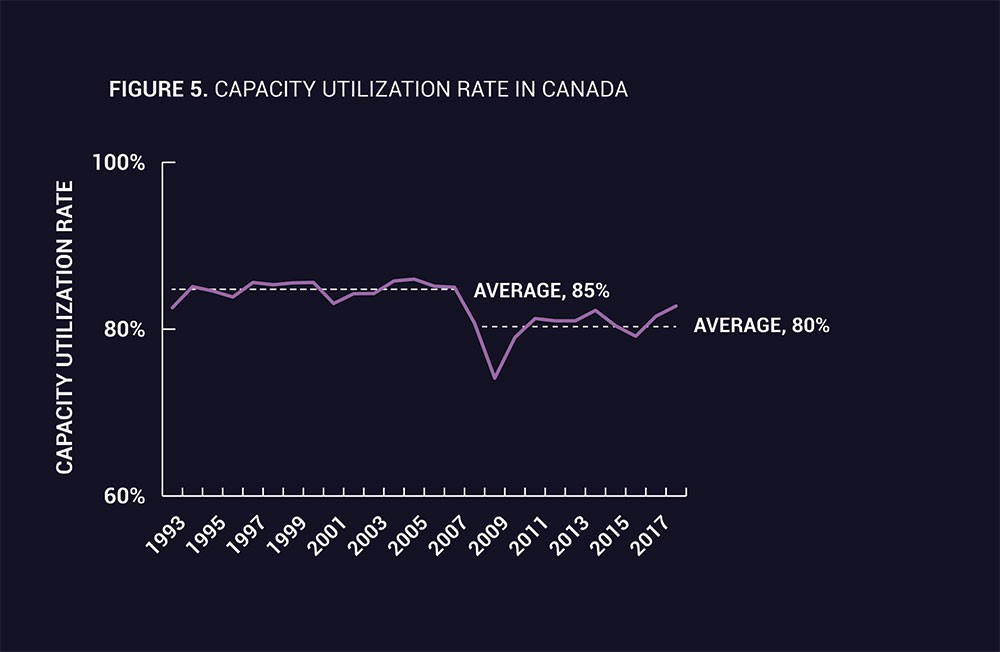

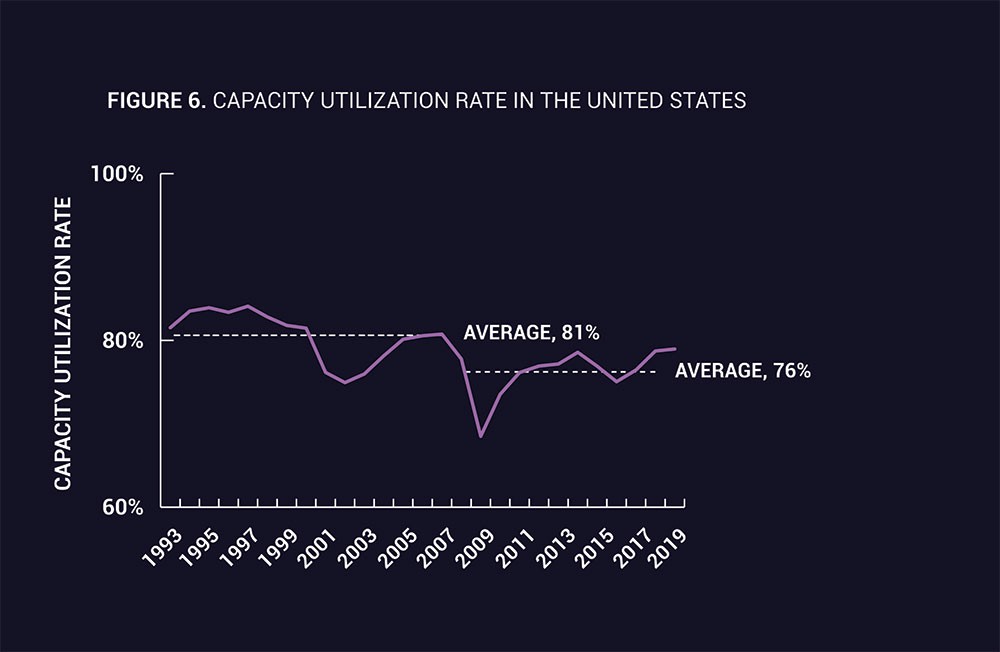

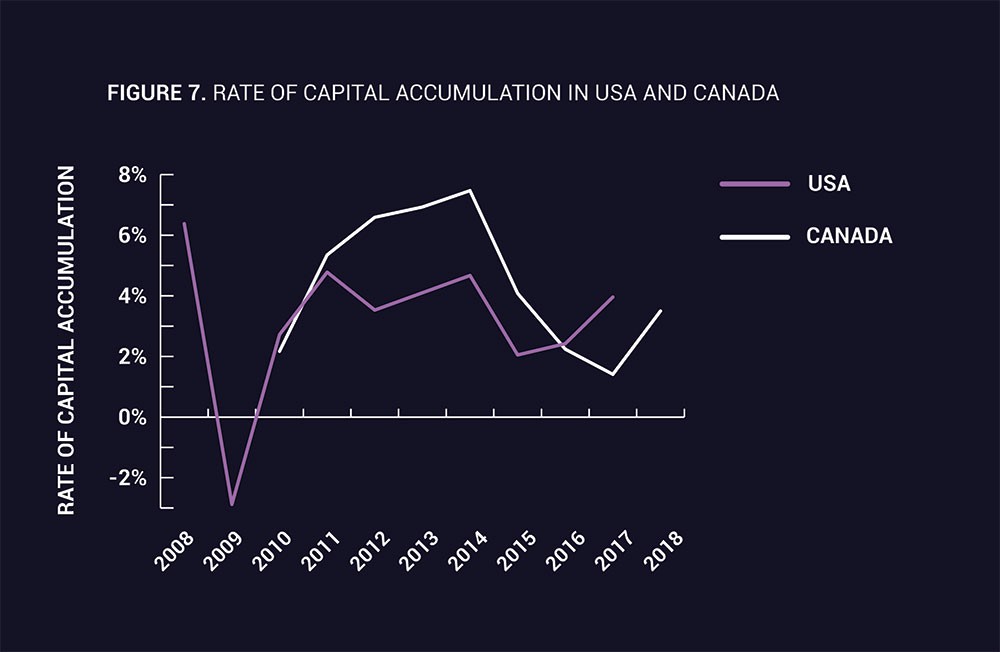

Over the first 10 years of the global slump, from 2008 to 2018, corporate profit in the U.S. grew by 4 per cent on average, below its historical average of 7–8 per cent, whereas it only grew in Canada by 1.7 per cent. As Figure 4 demonstrates, however, even though profit in the U.S. has been growing a little faster over the last decade, overall the growth rate has been slowing from a high of 15 per cent in 2010 to 4.5 per cent in 2018. This decline in corporate profit growth is reflected in weak rates of capacity utilization and capital accumulation, as shown in Figures 5, 6, and 7. The capacity utilization rate measures the overall slack in the economy. It tells us to what extent an economy is putting its productive capacity to use in producing commodities.

In the 15 years preceding the global financial crisis, the capacity utilization rates in Canada and the United States were 85 per cent and 81 per cent, respectively. During the Great Recession, however, capacity utilization declined significantly and has not recovered to pre-crisis levels.

Meanwhile, capital accumulation has slowed, as shown in Figure 7. The rate of capital accumulation measures the growth of a country’s capital stock, which includes machinery, equipment, buildings, structures, and intellectual property. From 2010 to 2017, the average rate of capital accumulation in the U.S. was only 3.5 per cent, three percentage points below the average of the eight decades preceding the 2007-09 recession. In Canada, the rate of capital accumulation averaged merely 4.5 per cent over the same period.

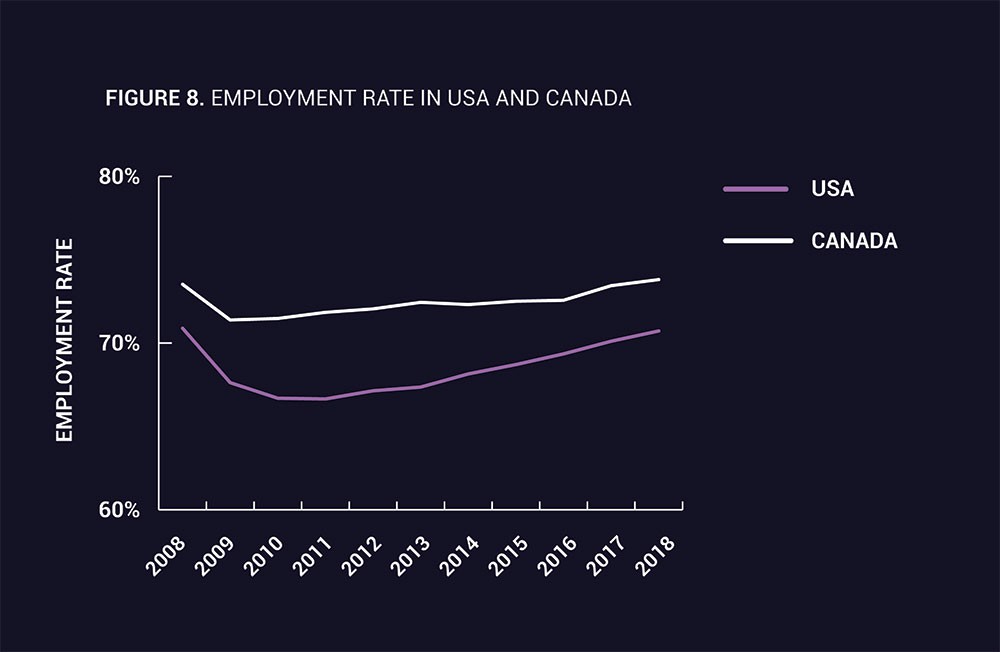

The weak capacity utilization and rates of accumulation have in turn translated into slow employment growth. By 2018, the American employment rate had yet to recover to pre-crisis levels. In 2008 it stood at 70.8 per cent. A decade later, 70.7 per cent. In Canada, on the other hand, the employment rate has been restored, but only just. In 2018, it finally rose above its pre-crisis level to 73.8 per cent, merely 0.3 per cent above its 2008 level. While Figure 8 presents data from the St. Louis Federal Reserve Bank, Statistics Canada data give slightly different figures, showing that the employment rate in 2019 is still below its lowest point during the Canadian recession of 2008-2009.

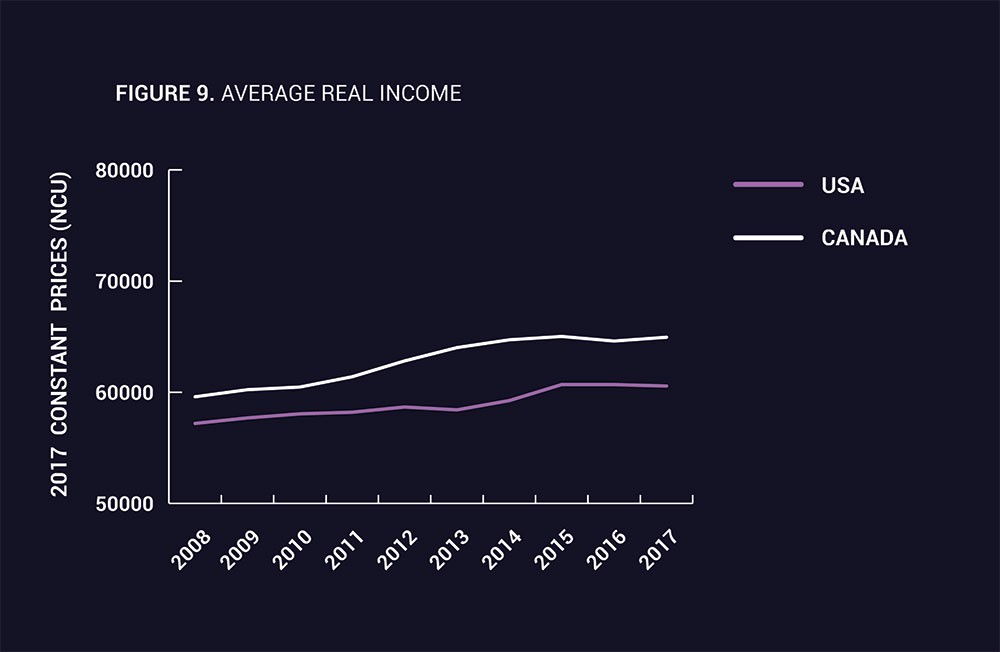

Alongside poor profitability, low capacity utilization, sluggish capital accumulation, and low employment growth, real incomes in the U.S. and Canada have been stagnating in recent years, too. Slowing demand for labour power tends to put downward pressure on wages, abetted by the assault on workers that has included cuts to social programs over the last two decades. Figure 9 presents average real annual income for the U.S. and Canada since the Great Recession in their respective national currency units. While average real annual incomes rose in each country after the Great Recession (excepting 2013 in the U.S.), after 2015 they shrank. In 2015, average real annual income stood at C$65,018 and US$60,692. In 2017, it stood at C$64,948 and US$60,558. Median real wages in Canada have been stagnant, too.

Not surprisingly, these developments are causing growing hardship and anxiety for workers. In a Canadian survey published by Ipsos in October 2019, 29 per cent of respondents said they cannot meet their debt obligations and will be insolvent at the end of the month, while 47 per cent said they will have to go further into debt to pay for their living expenses. In total, 48 per cent of respondents were merely C$200 or less away from insolvency. Wage stagnation has a profound effect on people’s lives and amplifies the financial precarity of many households.

The situation for Canadian workers is complicated further by the behaviour of Canadian capital in the face of poor profitability. Banks, for instance, have increased lending to households. Household debt now stands at a staggering 101 per cent of GDP. Furthermore, 80 per cent of household debt is in mortgages and home equity credit lines. These debts have helped to inflate a bubble in the real estate sector and have helped to drive real estate development, which has surpassed manufacturing as the number 1 contributor to economic growth. It now accounts for 13 per cent of GDP. In this context, in 2018, Basel’s Bank for International Settlements rang the warning bell for Canada, which it believes runs the risk of a banking crisis in the future.

Thus, Canadian capitalism is in a precarious state and a recession lurks on the horizon. Business and political leaders, however, plan to restore profitability and stability by redoubling the assault on workers and expanding exports of oil and gas to China.

The renewed assault on workers

As discussed previously, there are a number of measures that capitalists and the state can deploy to restore profitability and stability to capitalism. There are, however, two key aspects they are presently pursuing that we think deserve to be highlighted.

The first is the attack on workers, the vanguard of which has been Doug Ford’s Progressive Conservative government in Ontario. Ontario has the largest economy in the country and is Canada’s manufacturing base. Alberta and Saskatchewan, both central to the oil and gas sector, have also witnessed a renewed attack on workers’ rights, including suppressing the minimum wage and eroding collective bargaining rights.

The attack on workers is not new, of course, but if successful it will nevertheless deepen worker vulnerability and enable employers to increase the rate of exploitation. Labour productivity in Ontario, which measures real output per hour, increased from $48.90 in 2013 to $52.50 in 2018 according to Statistics Canada, or by 7.4 per cent. Over the same period, the real median wage rose by merely 3 cents from $20.79 to $20.82, an increase of 0.1 per cent. Low-wage work is also deeply racialized in Canada’s industrial heartland, where in 2011 workers of colour were 47 per cent more likely – and recent immigrants (those who arrived within 10 years of the reference year) more than twice as likely – to work for minimum wage than the total population.

Ford’s Making Ontario Open for Business Act and the Restoring Ontario’s Competitiveness Act, passed in the autumns of 2018 and 2019, respectively, are aimed at reinforcing these trends. These bills reversed the modestly progressive labour law reforms introduced by the former Liberal government in the autumn of 2017, in the face of pressure from the Fight for $15 and Fairness campaign. Most notable among Ford’s changes are the freezing of the minimum wage at $14/hour until September 30, 2020, which is intended to consolidate and increase low-wage work in the province. Along these lines, Ford gutted the previous government’s “equal pay for equal work” provisions for part-time, contract, casual, and temporary workers, incentivizing employers to hire workers into non-standard positions in order to keep wages down.

Workers of colour were 47 per cent more likely – and recent immigrants (those who arrived within 10 years of the reference year) more than twice as likely – to work for minimum wage than the total population.

Ford has also sought to tip the balance of power further in favour of employers by making it harder for workers to unionize and by limiting union coverage. Among other measures, Ford cut a new requirement introduced by the previous government, again under pressure by the Fight for $15 and Fairness campaign, that placed the onus on employers to prove they are not intentionally misclassifying workers by claiming that they are independent contractors rather than employees. The threshold of union cards required by workers to get employee lists from bosses was also increased, while sector-specific card certification in the home care, building services, and temporary help industries was terminated, and restrictions on “contract flipping” were lifted.

Ford’s plan to restructure welfare, too, making it easier to push people off of the Ontario Disability Support Program and into Ontario Works while cutting benefits, is a move to expand Ontario’s pool of workers most vulnerable to exploitation.

Colonialism and the expansion of the oil and gas industry

The other key pillar of the state and capitalists’ response to Canadian capitalism’s crisis is to realize profits abroad through the expansion of oil and gas exports. Canada has one of the largest oil and gas reserves in the world, and the investments already sunk into the sector are greater than those of any other in the Canadian economy.

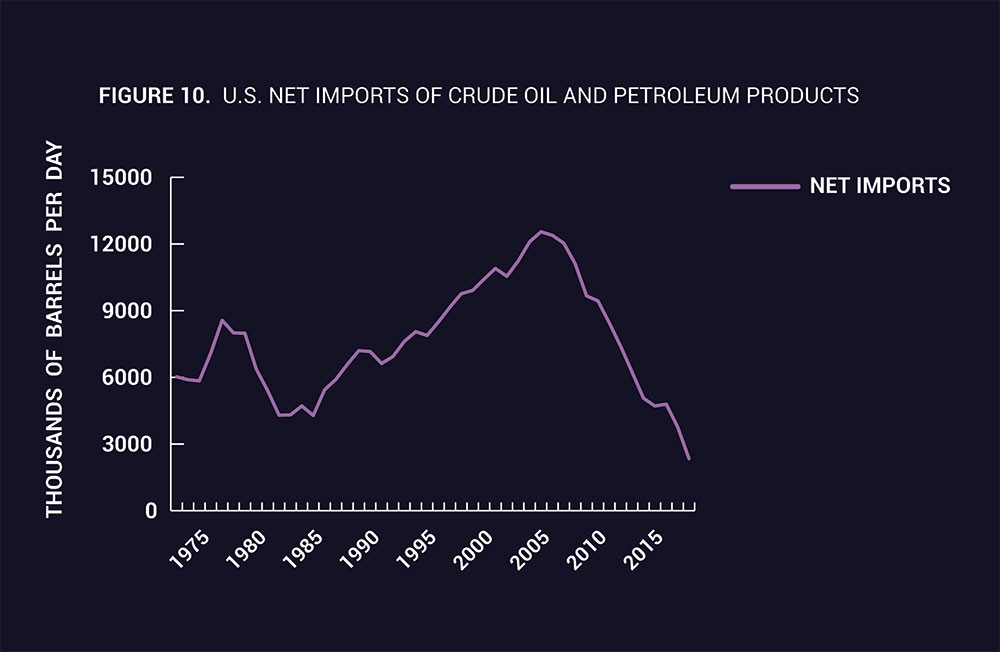

But this strategy faces a significant challenge. As a result of the development of its fracking industry, the U.S., as the main importer of Canadian oil, now produces more than it needs and is set to become a net exporter itself. As Figure 10 shows, U.S. net imports of oil and other petroleum products have dropped dramatically since 2006 and are at their lowest level since the collection of data on imports began in 1973. Investment in the sector in Canada has stagnated in recent years because it cannot get enough oil to market profitably, with already bottlenecked pipeline capacity becoming further congested, contributing to a drop in the price of Canadian crude.

The response of Canada’s business and political leaders is to pivot to East Asia, particularly China. China has emerged as one of the most dynamic centres of capitalist accumulation in the world, heavily dependent on and with a seemingly insatiable appetite for oil and gas imports. Its oil consumption is expected to surpass that of the U.S. by 2030.

Yet the potential represented by China remains unrealized. In a report funded by the oil and gas industry, the Canadian Chamber of Commerce echoes a frustration that appears in many industry reports on access to foreign markets. It notes, on the one hand, that “[t]he United States, the destination for virtually all of Canada’s oil exports, has dramatically increased its production of oil and gas to the extent that the International Energy Agency is predicting energy self-sufficiency for North America by 2035.” Instead, “[t]he fastest growing markets for Canadian oil and gas now lie […] in Asia, which is set to double its energy demand from 2008 levels over the next 30 years. […] This century’s great opportunities for trade lie in Asia; our energy commodities could open these doors for Canada.”

On the other hand, the report laments that “instead of emerging as a force in global oil and gas markets, Canada lacks the infrastructure needed to access new markets abroad and at home. We lack the infrastructure to get our energy to tidewater and overseas, and as a result must accept lower prices for our landlocked products.”

For their part, both the former Conservative prime minister, Stephen Harper, and the current prime minister Justin Trudeau have been keenly aware of the importance of China as an export destination, noting it in speeches and global strategy orientations.

We must be absolutely clear about this: Trudeau’s support for the oil and gas industry – including using paramilitary violence to dispossess Indigenous peoples in the way of pipeline routes to the Pacific – is not an accident, nor are these things simply the product of misunderstanding.

This explains why the Trudeau government is so invested – politically and financially – in pipeline expansion through British Columbia to the West Coast, whatever gestures it may make toward the existential dangers presented by climate change, the need to cut carbon emissions growth, and on the rights of Indigenous peoples. We must be absolutely clear about this: Trudeau’s support for the industry – including over $3 billion in tax subsidies, ignoring the science on tarsands extraction, spending $4.5 billion to buy the Trans Mountain Pipeline from Kinder Morgan to ensure it gets built, and using paramilitary violence to dispossess Indigenous peoples in the way of pipeline routes to the Pacific – is not an accident, nor are these things simply the product of misunderstanding such that, if only Trudeau were exposed to the facts or reason he would see the error of his ways. The Canadian state has evolved to optimize the conditions for capital accumulation. This commitment to Canadian capitalism is at its core a colonialist project – predicated upon and reproducing it – and is utterly irreconcilable with ecological sustainability.

This is, in other words, a ruling-class strategy to impose the burdens of the stabilization of Canadian capitalism on workers, Indigenous communities, and the environment.

Bracing for crisis

We cannot, of course, predict when a recession will come. The contradictions of capitalist accumulation never move evenly or with exact predictability across time and space. But history offers a stark reminder that crises cannot be avoided indefinitely, and while the edges of the last global downturn were blunted in Canada, it is unlikely they will be so dulled again. There is nothing exceptional about Canadian capitalism.

Political and business leaders and the Canadian state will do everything in their power to ensure the survival of the capitalist social order regardless of the cost to workers, Indigenous communities, migrants, the poor, and the environment. Capitalist crises are also periods in which conservative and far-right forces gain greater confidence to pry open space for their toxic blend of racism, anti-immigrant xenophobia, Islamophobia, and misogyny, a taste of which we have already had in Canada in recent years, if not on the same scale as in the U.S. or elsewhere in the world.

While the edges of the last global downturn were blunted in Canada, it is unlikely they will be so dulled again. There is nothing exceptional about Canadian capitalism.

The possibility for a different resolution to crisis lies in social movements that have the strength and determination to make the desires of capitalists and the state, and of the far right, unrealizable. Those movements do not yet exist on the scale needed, but glimpses of their potential power can be seen in the organizing efforts of the foodora workers in Toronto, Fight for $15 and Fairness, migrant solidarity activists, emergent climate justice campaigns, and Indigenous land defenders. Our task in the years ahead is to continue building and extending these and other yet-to-emerge struggles into a powerful force with the capacity and confidence to deepen people’s understanding of the ruthless logic of capitalism, effectively fight the intensifying ruling-class offensive, and advance a positive vision of an alternative that places human need above profit, democracy and planning above competition and chaos, Indigenous rights above violence and dispossession, and ecological sustainability above plunder.

Endnotes

(1) As should be clear from our argument, we do not subscribe to the underconsumptionist theory of capitalist crisis, held by Keynesians and some Marxists, which argues crises are caused by lack of effective demand. While we do not have the space to address it here, we believe it to be theoretically and historically deficient and to misunderstand the dynamics of capitalist accumulation. For critiques of it, see Anwar Shaikh, “An Introduction to the History of Crisis Theories,” or John Weeks, “The Sphere of Production and the Analysis of Crisis in Capitalism.” For empirical analysis on the causes of capitalist recessions see www.thenextrecession.wordpress.com.

(2) The data on Canada in this section comes primarily from the Statistics Canada database. While drawing on national databases designed by mainstream economists to construct Marxist ratios inevitably faces challenges, we believe nevertheless that they can offer a useful representation of those ratios in order to draw out the salient trends in capitalist accumulation in Canada. We continue to work to strengthen the datasets used in this article.

(3) The rate of profit measures surplus value over total investments in means of production and labour power. There are, however, some types of work that do not contribute to surplus value production. Instead, they consume it. Management, for example, when it is involved in monitoring and disciplining workers is involved in the extraction of surplus value but does not itself produce it. Net surplus value is surplus value less such capitalistically necessary but unproductive activities. Net surplus value over total investments gives the net rate of profit. The stagnating mass of profit can be attributed in part to the growth of unproductive labour (labour that does not produce surplus value), which grew faster than the mass of surplus value since 2005.